Logistics & Transportation Segment

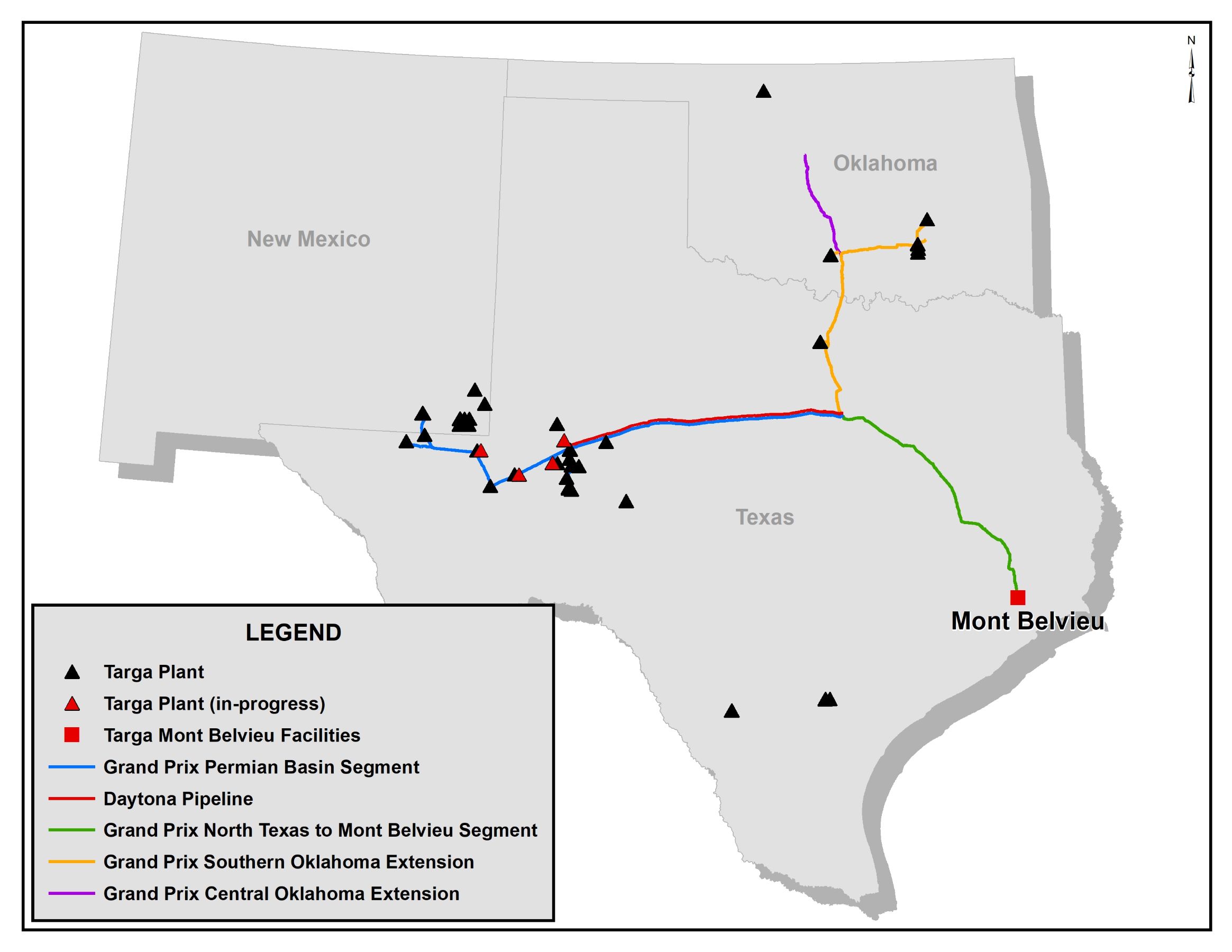

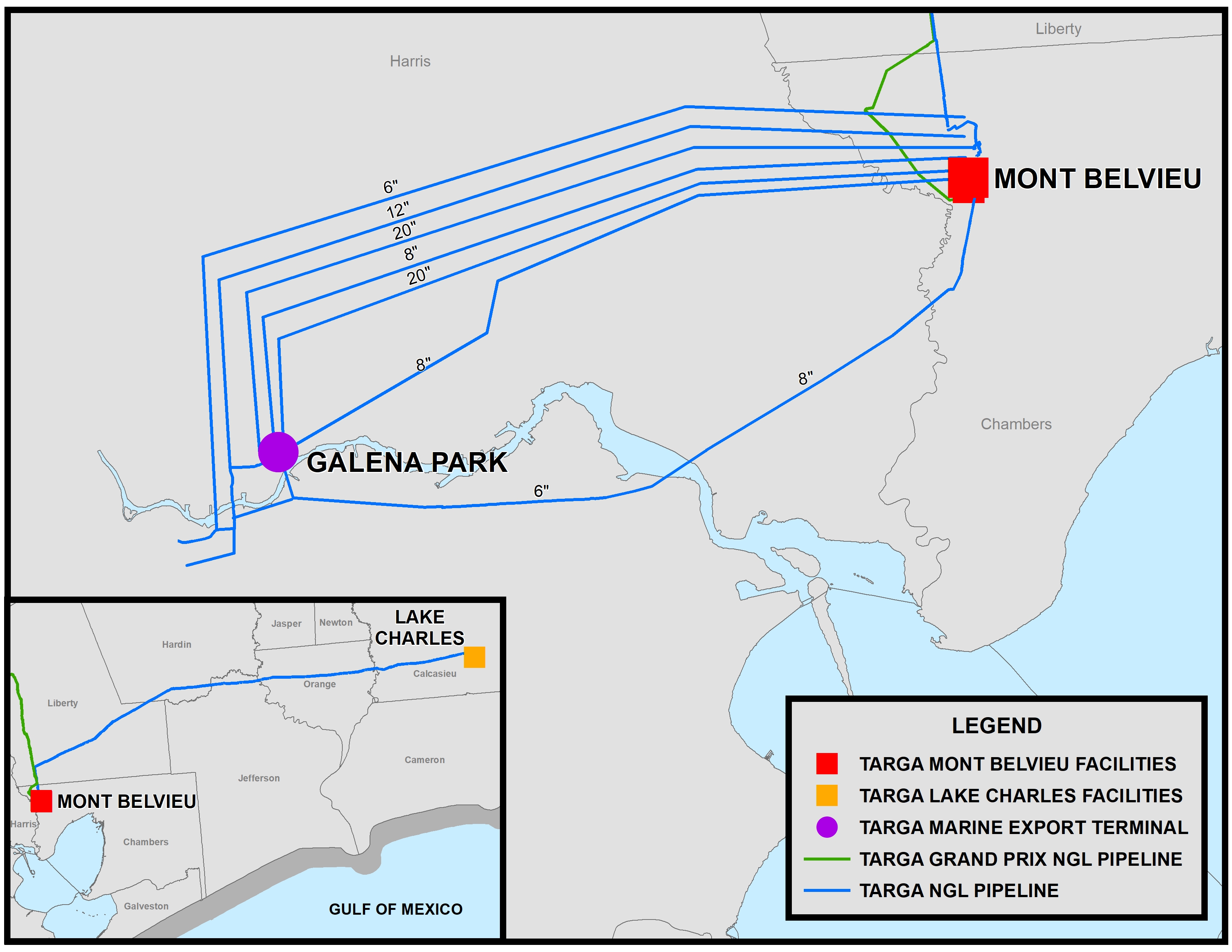

Our Logistics and Transportation segment is also referred to as our Downstream Business. Our Downstream Business includes the activities and assets necessary to transport and convert mixed NGLs into NGL products and also includes other assets and value-added services described below. The Logistics and Transportation segment includes Grand Prix and associated assets, which are generally connected to and supplied in part by our Gathering and Processing segment. These assets are located predominantly in Mont Belvieu and Galena Park, Texas, and in Lake Charles, Louisiana. Our fractionation, pipeline transportation, storage and terminaling businesses include approximately 2,300 miles of company-owned pipelines to transport mixed NGLs and specification products.

The Logistics and Transportation segment also transports, distributes, purchases and sells and markets NGLs via terminals and transportation assets across the U.S. We own or market products at terminal facilities in a number of states, including Alabama, Arizona, California, Florida, Kentucky, Louisiana, Mississippi, New Jersey, North Carolina, Pennsylvania, Tennessee, Texas and Washington. The geographic diversity of our assets provides direct access to many NGL customers as well as markets via trucks, barges, ships, rail cars and open-access regulated NGL pipelines owned by third parties.